|

CoolTrade

Performance Tips

There are a few things that subscribers should be aware of when running an automated trading platform.

Run

Long and Short Strategies

The markets go down, often times, more than they go up. Therefore, it is important to run a Long AND a Short stock trading strategy. Shorting the market is just as easy as going Long, since the software manages the positions and can just as easily take profits no matter which direction the market or your positions are going. If you set your auto trading program to take a maximum of 5 long positions and a maximum of 5 short positions, then no matter which direction the market is moving, you can take profits on something. One of the things we have learned with robotic trading is that those profits can add up quickly and can be more profitable than buying and holding positions forever. When you buy and hold, you may end up riding the stocks higher, then lower again without ever taking profits.

For new traders: Short means that you want the stock to go down in value, and Long means that you want the stock to go up in value. It has nothing to do with how long you hold a position.

Consider

Number of Long and Short Strategies Per Account

Due to the size of the online trading platform, there

may be a limit to the number of strategies that you can have loaded on each

account. If you want to run, say two long trading strategies, then you

may need two accounts. Also confirm if you have enough memory on your

computer for two or more accounts. Experienced active traders may run two or

more live long and short strategies, while having additional accounts for

trading strategies that they are testing in a simulator mode.

Consider

Blocking Certain Symbols

Your automated day trading system should include the ability to block certain symbols from trading. For example, if you're running a long trading strategy, you won't want to buy Exchange Traded Funds (ETF's) that short the market. More information on Exchange Traded Funds is available at Yahoo Finance.

The best automated trading systems

will include the ability to add to advancing or declining positions.

Within CoolTrade, Advancing Preferences will tell the Auto Trader what to do

when your stocks' prices are increasing. You may choose to either add or not add

additional shares to profitable positions. If you decide to add to these

positions, you can choose to add additional shares if today’s current bid price

is a certain amount greater than the highest purchased price or you can use the system predefined table which based on your inputs to the max trading range. The advantage in

choosing to add is the potential to gain additional profits as the stock is going up.

There is always a risk that if you add to already profitable positions that you

may be overpaying and the stock may drop.

Declining Preferences will tell the Auto Trader

what to do when your stocks' prices are decreasing. You may choose to add

or not add additional shares to losing positions. If you decide to add to those

positions, you can choose to add additional shares if today’s current bid price

is a certain amount less than the lowest purchased price or you could use the

system predefined table which based on your inputs to the max trading range.

The advantage in choosing to add is the opportunity to buy when the price is going down.

There is always a risk that if you add to already declining positions that the

price may not recover before the position is sold.

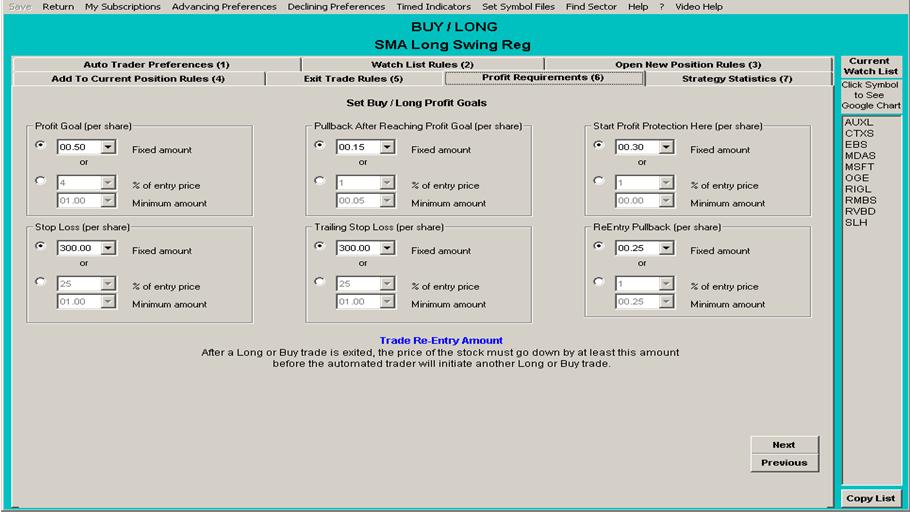

Robotic trading programs should give you the

ability to enter profit requirements and set parameters on how to handle the

positions if they continue to advance. You can tell the CoolTrade

Automated Trader to stay in each position until after it has reached your

profit goal. This tab also contains safety measures that you may take,

such as:

-Profit Protection, which is a reduced profit goal

-Pullback after Reaching Profit Goal

-Re-Entry Pullback

-Stop Loss

-Trailing Stop Loss

Set Profit Goal

This is the minimum price increase you

expect your stock will gain before its position should be closed. In

CoolTrade, you have two choices when specifying your profit goal. You can do

this in the form of a fixed amount or a percentage gain from your entry

price. If you would prefer to use the percentage gain from your entry

price, you can also specify a minimum amount in case the percentage gained is

too low. Specifying the profit goal doesn't guarantee that you'll make

this profit - the stock will need to reach this level

before the Auto Trader closes it.

Set PullBack

After Reaching Profit Goal

After the stock reaches its profit goal and

continues to rise, the CoolTrade Auto Trader will wait and let the profit

increase. If the stock price pulls back (decreases) this amount after it

has already reached your profit goal, the Auto Trader will close the position

and lock the profit. This pullback value has no effect before the profit

goal is reached. If you would prefer to use the percentage gain from your

entry price, you can also specify a minimum amount in case the percentage

gained is too low.

This is the amount that the stock must move

before the Automated Trader will consider re-opening a position after it is

closed. If you would prefer to use the percentage gain from your entry

price, you can also specify a minimum amount in case the percentage gained is

too low. If you set this value to zero, the Auto Trader will re-open the

position for a stock only based on the Open New Position Rules.

Most sophisticated stock trading systems will allow you to set stop losses and trailing

stop losses. The automated trader will close your position if the stock

price declines by your stop loss amount from its entry price. At CoolTrade you

can use the percentage gain from your entry price, you can also specify a minimum amount in case the percentage

gained is too low. Some traders set the stop loss at the maximum in the

system of $300, because they don't want to sell, therefore realizing a loss if the stock goes down.

Consider Trailing

Stop Loss

This is similar to the stop loss, except its loss

will be measured from the stock's highest point achieved during the trade. If you would prefer to use the percentage gain from your entry price,

you can also specify a minimum amount in case the percentage gained is too

low. Again, some traders set the trailing stop loss at the max but will

risk a margin call in doing so.

The Securities and Exchange Commission

(SEC) has imposed a $25,000 minimum on accounts they classify as day traders.

The definition involves the number of completed single-day trades in a five-day

period. More information about these regulations is available at www.nasdr.com.

It's important to

understand if you will be day trading first.

All pattern day traders must maintain a

minimum of $25,000 in equity at all times. Traders can satisfy a margin

account day trade minimum equity call by closing positions or by depositing

additional funds and/or marginable securities. Once an account has shown

a pattern of day trading, the $25,000 minimum equity requirement remains on the

account permanently.

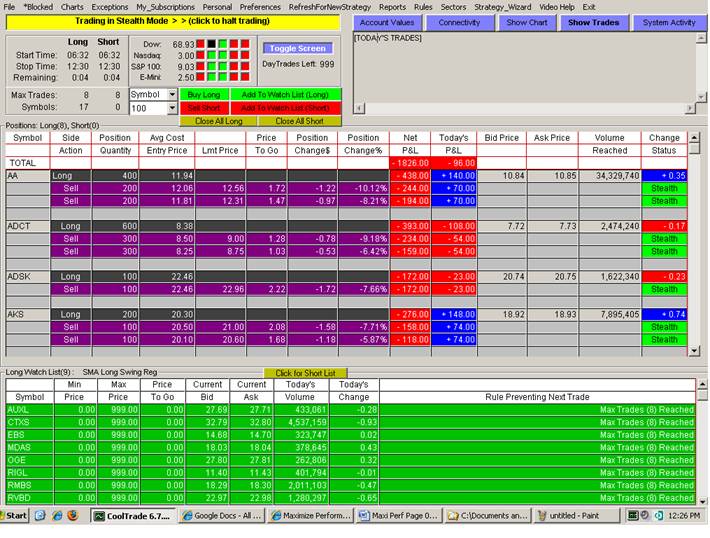

Day traders will want automated

trading software that tracks and displays the number of day trades

remaining. CoolTrade allows you to choose to have the Automated Trader enforce the SEC day

trader rules. If the number of your day trades exceed five during last five trading days including the current

trading day and your account value is below the SEC required $25,000, the

CoolTrade Auto Trader will cease the automated trading. But the manual trades through the Auto Trader are still

available. If you do not select this option, CoolTrade Auto Trader will

let your broker enforce the SEC rules.

The amount you decide to invest

depends on your trading style. A conservative trader can start with as

little as a few thousand dollars. Please consult your broker for the type of

account and funding requirements to suit your trading needs. Some

CoolTrade traders have found that $30,000 can a good starting point, as it

allows you to do 2:1 margin and qualifies the account for the SEC Day Trader

Rules with

a little extra to spare.

If you don't have $30,000 to invest, you can still use CoolTrade.

However, you won't necessarily be able to buy and sell the same security in one

day due to the SEC Day Trader Rules. That means that you won't be able to

close your open positions, even if you've met your profit requirements before

the end of the trading day. Remember, it depends on the strategy that you

choose, your comfort and experience level.

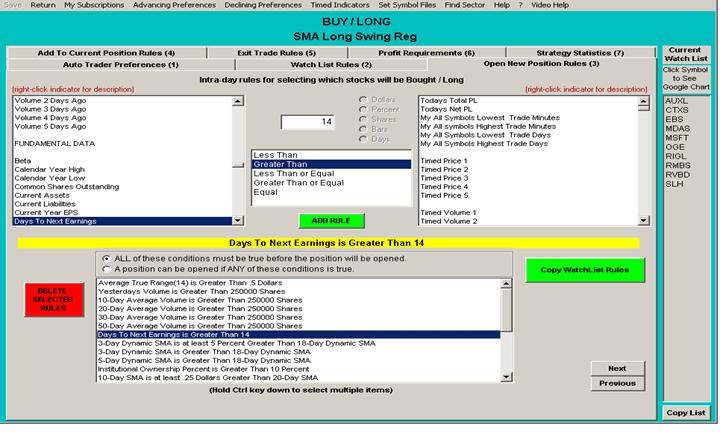

Use

Caution During Earnings Announcements

When earnings reports are released

and the results are lower than analysts' expectations, as is the case in a Bear

Market or during a transition between the two, the stock can take a big

tumble. If you want to guard against this, you can add a condition in

CoolTrade to your Open New Position criteria such that the Days To Next Earnings are Greater

Than x (days). Some traders use 5, 10 or more days. However, if

it's a Bull Market, by adding this restriction, you could miss an upside earnings

surprise and the profits that accompany it.

Reflect

on Down Days Before Making Changes

When the market has down days and you lose

money, you

don't necessarily need to change your strategy. Look at your trades for

the remainder of the month and if they've been profitable, then stay the

course. Some long strategies will open more positions during a down day,

when the prices are lower. You may sometimes make a profit if the market

is down in early trading and if it bounces higher later in the day. Review the overall

results of your trading strategy for at least four weeks. Weeks of losses

or no trades when the market is up will indicate that your strategy likely

needs to be revised. See the “off

the shelf” Strategies that

are available at no additional charge to CoolTrade subscribers.

Schedule

Your Auto Trader to Turn on Automatically

To ensure that you are trading right

at the market open when a lot of the action occurs, schedule your PC to turn on

the Auto Trader automatically. For many PC's, the Schedule Task function

is within the Control Panel. Many stocks trade heavily in the first 5 -

30 minutes after market open. Some close positions in the last 20-30 minutes before the

market closes.

The max bid/ask range is the maximum bid ask

difference that you will accept before any position is opened. Some

automated trading programs will allow you to set a limit on this. You'll

want to consider how wide a "spread" you'll accept. Since you Buy on the Ask

Price (higher number) and sell on the Bid Price (lower number), you are

immediately a loser at the instance you open a position. How much of a loser you are depends on this

spread. You can have a huge advantage if

you only enter trades while the spread is small. In fact, this is such an important rule that

all of the default CoolTrade strategies

have the Max Bid/Ask Range set to .02.

Research

Brokers Before Trading in a Retirement Account

You can you day trade in an

Individual Retirement Account (IRA) but not all firms allow your trade proceeds

to be available to continue to open new positions immediately. Interactive Brokers is the only

broker that we are aware of that offers something called an "IRA-MARGIN” account. All other brokers only offer IRA-CASH

accounts. An IRA-MARGIN account frees up

your funds immediately after every trade and thus allows you to continue

opening and closing positions without a waiting period. Whereas, an IRA-CASH account takes 3 days to

clear funds and makes you wait 3 days before you can utilize the funds again,

even if you have no open positions. Even

though they call it an IRA-MARGIN account, you still cannot borrow funds or

short in an IRA account.

If you have any tips you'd like to share, feel

free to post them on the CoolTrade

Community Board. Happy trading!